Regulatory Reporting Solutions and Data

Comply with ever-evolving regulatory reporting rules. Our data provides attributes specifically built to enhance regulatory reporting across your futures and options contracts.

Minimise Risk. Achieve Compliance.

Minimise the risk associated with non-compliant transaction reporting under MiFID, EMIR, CFTC and more.

Trusted Data

Leverage in-use and trusted regulatory reporting data for futures, options and OTC-cleared contracts globally.

Easy Integration

Ensure regulatory compliance across multiple trading platforms and workflow systems through data customised for proprietary enterprise-wide repositories, security master files or EDM vendor solutions.

Fit-for-purpose

Take advantage of a regulatory reporting data service that has been curated and enhanced for well over a decade with clients, alliance partners and regulators.

What Our Regulatory Reporting Data Can Do For You

Our data makes it simple to comply with the rules of regulatory trade reporting mandates by providing attributes that are built for your contracts, across asset classes and exchanges, covering the relevant regulatory technical specifications.

Reduce the risk of non-compliance

Enhance pre-trade regulatory risk analysis

Trade new products with correct regulatory attributes

Reduce the cost of internal regulatory databases

Data Delivery In The Format You Need

Our data solutions can be accessed on demand within our data platform or in a range of formats and scales to fit operational requirements.

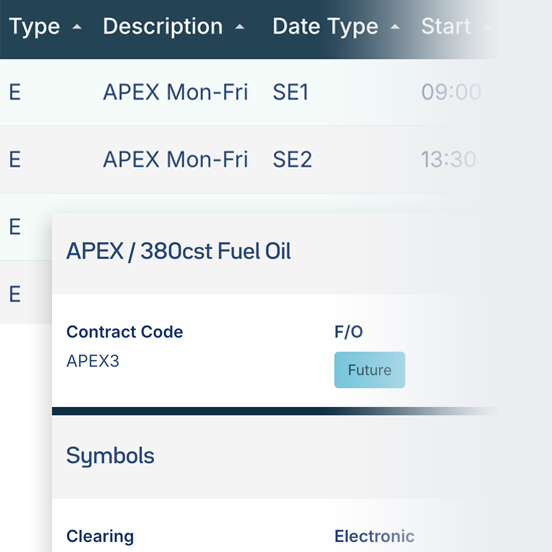

FOW Platform

A single, easy to use platform that puts all of FOW's data at your fingertips.

API

Anytime access to machine-readable, high-quality reference data directly into your system.

Data Feeds

Delivered by SFTP, ensuring every function and system across your business uses the same common data.

All the fields and filtering that we need isn't provided by the trading systems, so you need the third-party reference data that FOW provides to do that screening and filtering and report correctly, but also to give the extra product information that the regulator is looking for.

Sell Side T2, Head of IT Development

Key Features

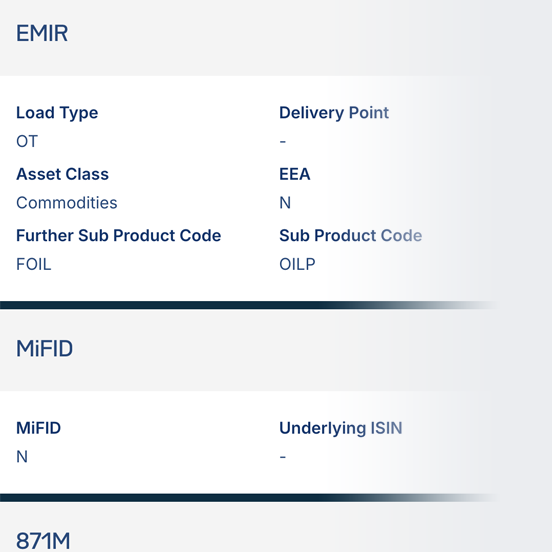

MiFID/EMIR - ISIN, CFI, Asset Class, Categorisations and ToTV indicators

MiFID/EMIR Delivery Point, Duration, Days of the Week and Load Delivery Intervals

MiFID/EMIR Commodity Base and Commodity Details

CFTC Exchange and Commodity Codes, Large Trader Reportable Levels, Foreign and Trade Organisation Product Allocations

IRS 871(m) reporting eligibility indicator

Featured case study

Regulated multilateral trading platform needing to respond quickly to changing regulatory reporting obligations

Read Case Study

Request Data Access

Discover trusted, standardised derivatives data from 120+ global exchanges. Seamlessly access FOW’s comprehensive reference data via API, data feeds, or interactive platform—trusted by industry leaders for accuracy and consistency.

Submit

Related Insights

Gain better insights into the value and quality of our data and how it can support your business needs.

Explore Our Other Data Solutions

25+ years sourcing and curating the best quality reference data into solutions to meet all your trading, operations and reporting needs.