Case Study

Regulated multilateral trading platform needing to respond quickly to changing regulatory reporting obligations

About the company

Regulated, global, finance services provider providing market liquidity, access and infrastructure solutions, this firm connects customers to a global network of exchanges for trading and data.

Challenge

A market leader in digital technologies supporting financial trading, this organisation is a regulated multilateral trading facility and regulatory reporting-eligible entity with a dedicated Reporting team managing multi-jurisdictional compliance.

Responding to evolving regulatory reporting obligations

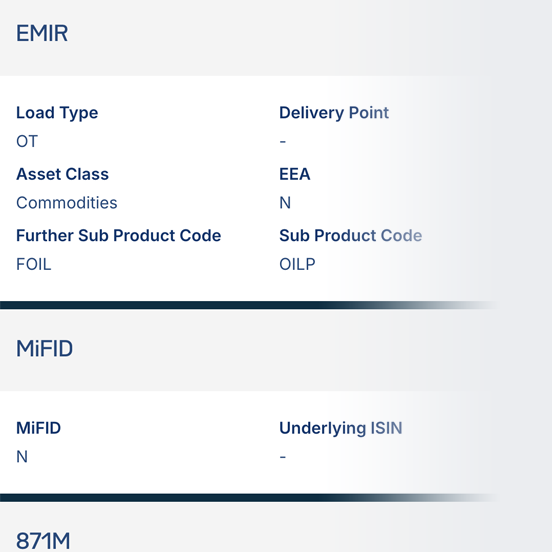

Meeting new EMIR Refit reporting obligations from April 2024

Solution

Enrichment and expansion of reporting fields to accommodate new reporting fields for EMIR that became mandatory in 2024.

Tailored EMIR data file attributes (asset class and exchange)

Accurate, reliable and consistent data for reporting compliance

Enhanced pre-trade regulatory risk analysis and remediation (historical data)

Benefits

Fast, efficient and effective delivery of data supporting compliance with evolving regulation in multiple reporting jurisdictions.

Data compliant with regulatory technical specifications

Data delivered in customer-defined formats and channels

Customer can trade new products with correct regulatory attributes

FOW solutions

This client’s requirements were met with the following FOW solutions.

Download full case study

DownloadRequest a Demo

Find out how you can benefit from a seamless access to FOW’s extensive data, market analytics and industry insights.

Submit