ANALYSIS: Broad-based growth drives benchmark adoption in CME energy suite

11th November, 2024|Radi Khasawneh

CME Group has seen a spike in adoption of its US crude oil and natural gas derivatives as the country’s increasing prominence as an exporter has driven demand for pricing tools.

Speaking to FOW as the exchange reported a 16% increase in energy average daily volume in October, to a calendar month record of 2.7 million lots, CME’s global head of energy and environmental products said there is increasing demand across the segment.

Growth in the main West Texas Intermediate (WTI) futures complex was stable, with October daily volume of 903,000 lots, 5% higher than the same month in 2023, according to exchange figures.

CME Group’s main Light Sweet Crude (CL) futures contract, which is deliverable in Cushing, Oklahoma, had in September and August its two strongest months since March 2022, reporting average daily volume (ADV) of 986,320 contracts in September and 972,400 lots in August, up 6% and 18.7% on the corresponding months last year, according to FOW Data.

WTI crude oil monthly options average daily volume at the CME was 229,000 lots in October, 38% higher than last year while open interest has risen 6% to 2.5 million contracts, according to the exchange.

“The real growth story for us has been in the options space - that is a very robust liquid market that is growing,” Peter Keavey said in an interview. “That has been most pronounced in our weekly options product suite, and, with expiries every trading day of the week, we have seen adoption increase.

“The single day volume record was set on October 18 with 58,000 lots traded, and on October 24 we hit an open interest record of 89,762 contracts. That shows the market is utilising an increased number of tools around the WTI Cushing contract to manage risk.”

The use of weekly expiries has risen 85% in the period to 31,000 lots a day in October, reinforcing the shift to options.

“One of the most important stories of the last couple of years has been the trading of the US Gulf Coast as a pricing point,” he added. “Our contracts combine to create the most liquid and highly utilised basis risk management product for the Gulf Coast market, and that is apparent from the volume and open interest levels we have hit.”

The CME has established WTI Houston and Midland contracts (traded under the HTT and WTT codes respectively).

October was a record ADV month for the combined grades, which are based on Argus assessments, of 19,400 lots, 126% higher than the same month last year, according to exchange figures. Open interest in the month was an average 719,000 lots, a year-on-year increase of 38%.

And CME has responded with new products, including the launch of WTI Ex-Pipe (Argus) versus WTI Trade Month contracts last month on its NYMEX market.

“We talk to physical traders all the time about expanding into other sub-markets within that basis area,” Keavey said. “The XTT contract we launched in October is a good example of that, and indicates the rapid growth we continue to see in the complex as well as the wide acceptance of them from large commercial customers as the most important pricing benchmark for the industry.”

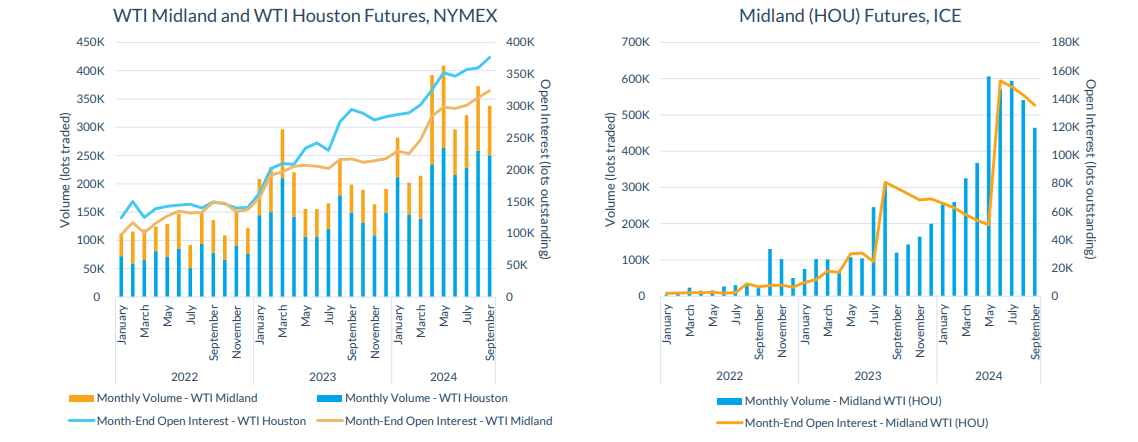

The CME competes with Intercontinental Exchange (ICE) in the Gulf Coast market, and ICE has made strides in expanding physical delivery markets for its own Houston contract. Taken as a whole, ICE has built a lead in volume traded this year, while CME dominates open interest in the market in each of its contracts (see graph 1).

Graph 1

Source: FIA

The increase in US Liquefied Natural Gas (LNG) exports, which started eight years ago when there was an expansion of shale production, has also provided the impetus for trading of CME’s Henry Hub benchmark used to price the majority of LNG agreements on US gas, according to the CME.

“Henry Hub has never been more globally relevant than it is today, even though it is a 34 year old contract the advent of LNG exports directly indexed to the benchmark has been increasing dramatically since 2016,” Keavey said. “Uniquely, there is a large and dynamic supply market behind the facilities as well as an offtake base gas market that is robust and traded off the same market. As this market gets more interconnected over time the most important risk factor is Henry Hub. It is linked to 11 pipelines, many of which feed the LNG facilities so it does benefit from physical proximity.”

Speaking on a webinar to discuss volumes for the first nine months of the year, the senior vice president of publications, data and research at the FIA agreed that contract has grown in importance as the need for price discovery has expanded across regions.

CME Henry Hub futures saw ADV rise by a quarter last month, to 500,000 contracts, and open interest hit a new record of 1.73 million contracts on October 30, beating the previous high of 1.65 million lots in October 2018.

“Henry Hub natural gas is the benchmark for the US natural gas sector, and what I find quite interesting is how it has become increasingly important as the flow of natural gas from the US has increased to the outside world,” Will Acworth said. “CME estimates that roughly 25% of the volume in Henry Hub futures originates from outside the US, and I think one of the key factors is that the producers and the merchants who are moving that gas to the Gulf Coast or to other liquefication facilities and then putting it on tankers across the Atlantic or Pacific to buyers in other parts of the world are hedging the price risk somewhere in that process by using this contract.”

That manifested itself more recently with a 57% growth in Europe, Middle East and Africa (EMEA) trading to 111,000 lots in ADV for the year to November 7, according to figures provided by the exchange. Asia Pacific volume rose 15% on the same basis to 12,800 contracts.

“This is our fastest growing major benchmark, and trades over half a million contracts a day, so that is a large liquidity pool that participants can rely on to manage their risk,” Keavey said. “Non-US participation hit all time highs this year, and we are seeing meaningful contributions across regions. A major part of this market is now being traded internationally, and as such is a linchpin for LNG traders.”