FOW Products

FOW’s unmatched derivatives expertise in critical reference data services, market intelligence, timely industry insights and analysis brought together on a single, always-on, platform or as a customised data feed and integration solution.

FOW Intelligence

Industry intelligence and market tracking

Timely and comprehensive industry intelligence and market analysis, alongside essential traded volumes and open interest data, on a single, user-friendly platform. Focused, accurate and relevant insights for derivatives trading professionals.

Singular market focus

A rich combination of market insights, in depth analysis and real time alerts ensure you’ll never miss pivotal market events.

Inform better decisions

Take a deeper dive into critical topics with in-depth analysis, expert commentary and regular themed reports.

Uncover liquidity

Interactive charts, comparative volume and open interest data, and liquidity data aggregated by market, exchange and asset class.

FOW Professional

Critical data and market intelligence

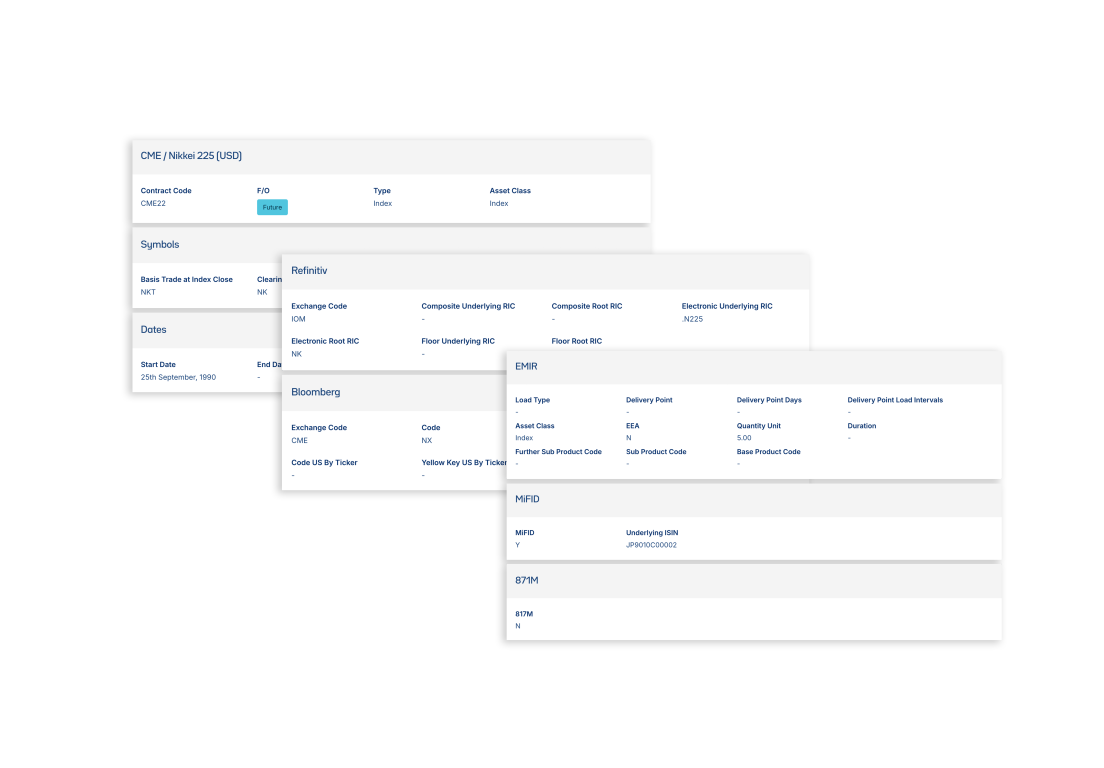

The best futures and options reference data and market intelligence available today – all in one place. Extensive, broad-based contract and volumes data enriched with industry insights, analysis and market intelligence.

Less complexity and time

Instant access to the best reference data including trading dates, contract specifications, volumes and regulatory compliance – reduces time and simplifies management of multi-exchange datasets.

Stay ahead of events

View and capture vital reference data, liquidity data aggregated by exchange and asset class and timely industry insights and market intelligence to stay on top of market trends.

Always available

An ‘always on’ service that can be easily accessed anywhere, with no technology integration. Simple, intuitive web interface and API access options.

FOW Premium

Custom data solutions and integration

Validated, high quality reference data and symbology mapping, integrated seamlessly with client systems (bespoke feed/API) reducing trade execution and operational risk.

Consistent, quality data

Standardised reference data supports trading performance and regulatory compliance. Unmatched coverage of 110k+ contracts on 115+ exchanges.

Less complexity and cost

Specialist technologies, workflow automations and enterprise integrations remove complexity and cost, enhance data management, accelerate trading performance and increase client loyalty.

Specialist service support

Rigorous onboarding, bespoke data delivery solutions and dedicated relationship management from industry and data management-expert specialist team.