Small to medium sized firms can now access the same market data sources as the largest investment banks but at significantly lower costs.

For small to medium investment firms, cost-effective access to market data sources enjoyed by major international banks, prior to on-demand innovation, was usually a one size fits all choice, alleviated somewhat, by carving out distinct markets but not at a contract level. New technology and innovative commercial models are now generally available from market data distributors (MDDs) which offer per security requests, albeit at a premium, being multiples of all- universe average unit prices. For a small to medium trading firm, the ability to scale input costs to match portfolio activity is critical to maximise returns while building up a book of business.

Specialist symbol mapping services for market data are available for the wider and deeper demands of the large international trading firms, but the innovation of data solutions that combine the best of on-demand technology with commercially available contracts, mean that small to medium firms can now use dynamic symbol transformation, specifically tailored to their portfolios, to access the same market data sources as the largest investment banks but at significantly lower costs.

Per security market data costs are minimised by only requesting information on the open positions a firm is actively managing. Data requests may contain both price and reference content that can be applied for portfolio valuation, risk management, margining and enriched client reporting.

Even a small to medium investment firm has a number of system components to their trading operation and it is symbol translation that provides the persistent linking of these components, in the form of data passporting, which enables system inter-operability and solution delivery.

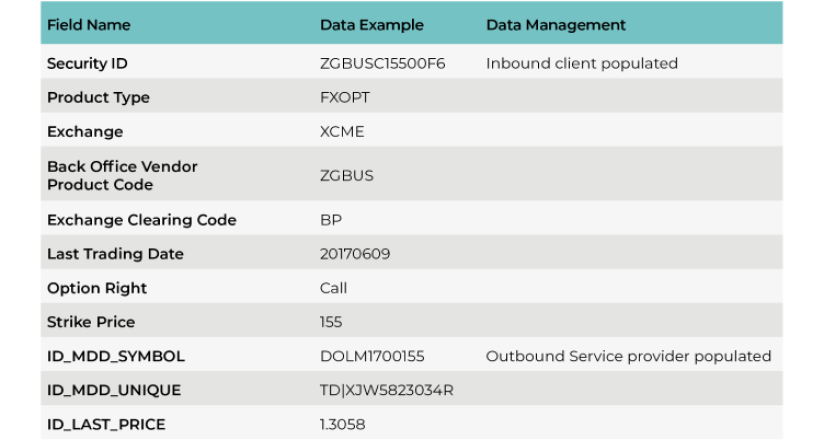

Data Transfer - Inbound open position data received from client

This innovative reference data solution comprises a core three-step process after initial client data transfer:

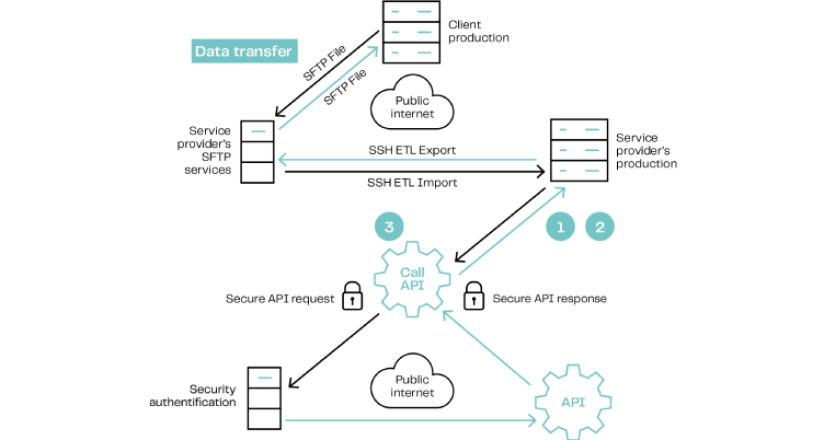

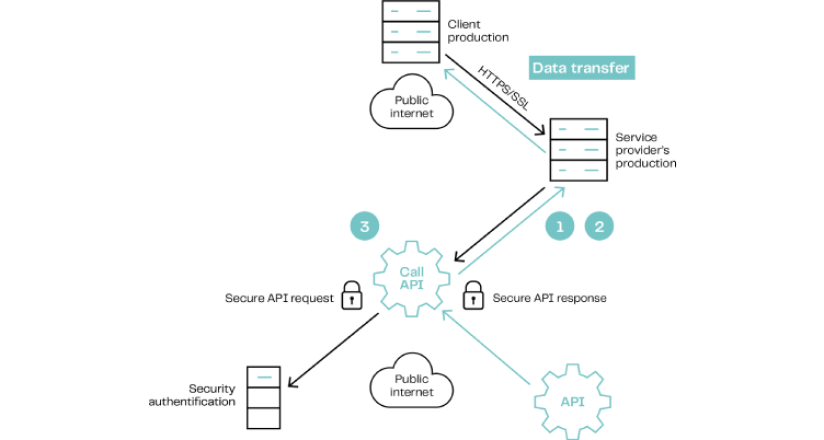

The start of the process involves the generation and secure delivery of the client’s data of open positions in traded futures and options contracts in a standardised format with client populated records in inbound fields:

Security of Sensitive Information

Information security in the cloud or service environment is expected from any supplier and this solution utilises modern encryption and storage standards to meet this essential requirement.

Secure file transfer SFTP with public and private key encryption, SSH and SSL secure connection methods are used and hosting centres are ISO 27001 compliant.

1. Open Positions Matched to Products in Database

Mapping to contracts in the service provider’s securities master file is carried out based on pre-determined transformations to verify the contracts in scope. This can include the resolution against specific trading system vendors’ unique identifiers at both product and contract level and substituting recognised field names from matched contract text name search strings.

2. Synthetic Ticker Symbols Created and Appended to Contract Records

Synthetic series level tickers are then constructed for each contract record in the MDDs prescribed format. The method of ticker construction is different depending on whether the contract in scope is a future or option and which asset class the contract belongs to.

MDDs acceptable formats for tickers vary with some requiring a prompt month to be single, double digit or a combination of the two separated by space. This is usually determined by how long a contract is set to trade until, for example the contract’s final last trading date. When receiving data from a client this is not always possible to ascertain. For example, a client may provide series data for a contract from the current month and year to five years in the future, whereas the MDD may have trading data for the next fifteen years for the same contract.

3. Ticker Symbols Used to Request Market Data Per Security

Ticker symbols are used to request market data from the MDDs per security API. In order to cater for every permutation, the API call process is dynamically managed to optimise calls to retrieve the correct market data for each asset type, until the client file enrichment can be successfully completed. Market data returned per contract then populates the client’s inbound open position datasets.

Data Transfer - Enriched Open Position Data Returned to Client

Market data enriched client datasets are then transferred securely to the client, who then loads the records into its trading systems to perform its unique portfolio management functions.

Solution Benefits

High quality market data for small to medium firms

Low cost access to leading market data sources

Scalable to automatically fit operational requirements

Market data spend optimised for open positions only.

Symbology - Process overview - using SFTP

Market Data Distribution API Request Flow

Symbology - Process overview - using HTTPS/SSL

Market Data Distribution API Request Flow

Contact us to find out how we can lower your costs, but still give you data sets you need, when you need it and how you need it.