The cross-asset efficiency advantage

12th November, 2024|Christian Voigt, head of Markets, Broadridge Trading and Connectivity Solutions

Are multi-asset class trading capabilities on your firm’s list of order management system (OMS) must-haves? If not, they should be.

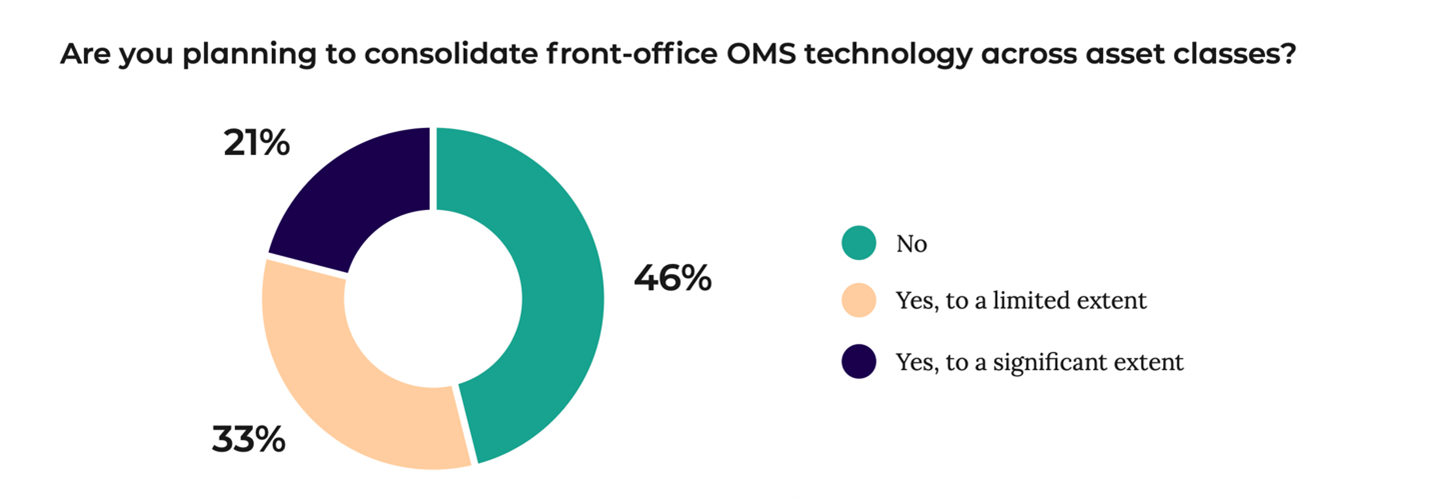

As we explored in our 2024 front-office research report with Acuiti, many futures commissions merchants (FCMs) are pursuing order management system (OMS) consolidation to improve operational efficiency. One way they’re achieving this goal is by implementing a multi-asset OMS solution. This approach allows them to consolidate workflows across asset classes.

While operational efficiency may be the drive of change, many FCMs who implement an OMS solution with this feature enjoy a range of other benefits, such being able to provide customers with an improved, more consistent, experience.

Holistic portfolio management

Multi-asset investment strategies, also referred to as multi-asset solutions, typically combine asset classes with the objective of producing one or more specific investment outcomes, such as achieving long-term capital growth, improving risk-adjusted returns, generating income or matching a particular liability profile.

Interest in this strategy grew following the 2008-2009 financial crisis. Institutional investors, initially pension funds and insurance companies, whose portfolios had lost money but outperformed the market, began to look for an alternative approach.

The introduction of Mifid II in 2018 increased adoption of this strategy in European markets. Heightened regulatory scrutiny around product appropriateness and transparency meant that continuing with the status quo became unviable.

Target date funds offer a prime example of how this strategy has grown. This retail-focused multi-asset strategy accounted for $3.5 trillion (£2.7tn) in assets under management (AUM) at year-end 2023.[i]

That’s larger than the entire market was 20 years prior when it stood at $2 trillion in AUM across a broad range of multi-asset strategy products.[ii]

A multi-asset response

To best support this growth, many buy-side firms have reconfigured their trading desks, breaking down traditional asset class silos. A multi-asset class OMS solution allows sell-side firms to respond to this holistic approach.

Until recently, cross-asset OMS solutions for futures and options were limited. I mentioned in a previous article, that FCMs often rely on one or more OMS platforms to support specific asset classes as well as region-specific solutions and workflows. Now that many technology providers, including Broadridge, have invested significantly in this area that is changing.

Leveraging these new solutions, FCMs can now respond to their client’s trading needs in the same way that broker-dealers can. More than half of those surveyed for our report plan to take advantage of this capability.

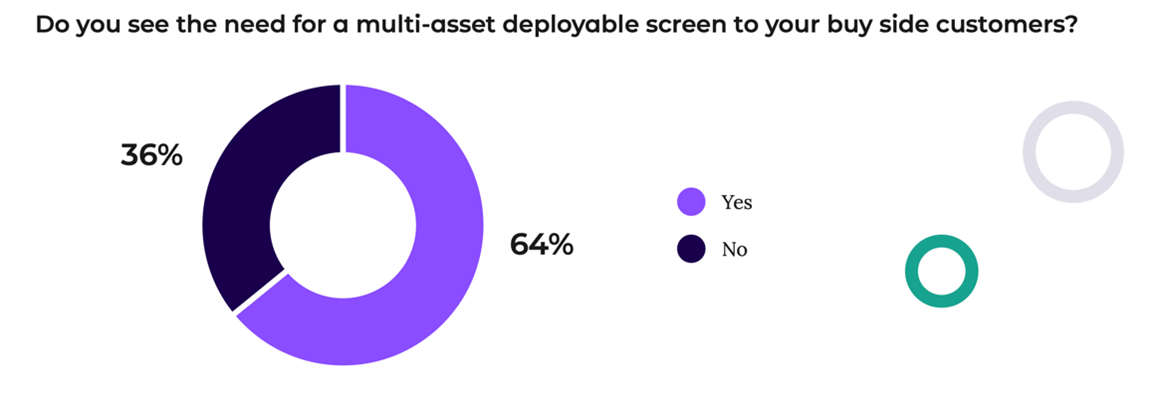

The majority of these senior, front-office executives indicated the need to offer clients a cross-asset trading solution.

A cross-asset perspective

The benefits of a trader using a cross-asset platform aren’t limited to transactions done on behalf of multi-asset funds. In our interconnected, global market, assets don’t move in isolation. Being able to see and execute across the larger market structure is crucial for the long-term success of any FCM.

Even those who only trade a specific asset class or market segment still need the broader view. The most straightforward example is a trader on an equity options desk. They need to be looking at the underlying stocks to better understand the options they trade. Likewise, firms want their bond traders to follow the swaps and futures market. Access to a multi-access platform allows traders to better identify and understand return correlations and other market trends.

Another consideration is that there are now an increasing number of ways to obtain specific risk exposures. Look at how equities, equity derivatives and ETFs are competing for volume and price discovery. And once you manage a large baskets of various equity related instrument, it is just a small step to hedging your FX risk.

The new face of competition

Another theme that emerged from our state-of-the-market report was the impact that a new breed of competitors — tech-savvy, cloud-native firms — have had on traditional FCM’s competitive landscape. While many of these firms started by focusing on low-touch, retail traders, they’re now beginning to move into the institutional space, bringing with technology that is unencumbered by legacy systems. In addition, FCMs face growing competition from electronic liquidity providers who have already made significant inroads in ETFs and equities, and are growing their offerings in listed markets.

There’s more than one way to….

Given that FCMs identified customer service and execution services as two of their strongest selling points, the growing interest in a multi-asset platform is no surprise. However, that doesn’t mean they’re ready to throw away their legacy systems and start from scratch. Few, if any, established FCMs have the luxury of this approach.

Indeed, this “big bang” strategy of OMS consolidation comes with its own set of risk and challenges. How will you continue to day-to-day operations and create a seamless transition for clients in the face of such a dramatic move?

While every firm is unique, most will do better with an API-based integration approach. With a modular approach, your OMS will be more flexible. Updates can be made without impacting the entire system. You can also still consolidate and scale back to a handful of carefully selected OMS platforms.

Looking to the future, it’s always to a good idea to keep in mind the cyclical nature of OMS innovation.

While not specific to multi-asset class OMS solutions, the one system versus several debate is ongoing for many years. Right now, the trend is toward system consolidation. Those FCMs who have gone the modular, API-based integration approach, will be best positioned for this new cycle.

London-based Christian Voigt has more than 15 years of experience as a product manager specialising in equity and derivatives market structure. Christian previously worked as a trading design manager at Eurex, a senior regulatory adviser at Fidessa and in business development at XETRA.

[i] Sway Research, “The state of the target date market: 2024,” accessed October 24, 2024.

[ii] FTSE Russell, “The growth of multi-asset investing, (Part 1),” September 2020, accessed October 24, 2024.