The "70/30" rule for effective transaction data management

17th March, 2024|Staff Writer

While perhaps regarded as being at the less glamorous end of the transaction data spectrum, reference data in fact accounts for some 70% of all of the data required to be captured in every financial market transaction.

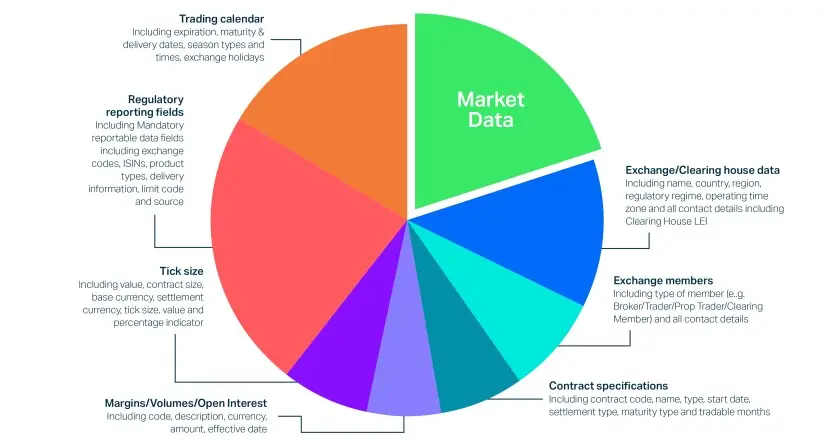

While perhaps regarded as being at the less glamorous end of the transaction data spectrum, reference data in fact accounts for some 70% of all of the data required to be captured in every financial market transaction. As such, it is absolutely critical for successful trade execution - and for navigating trades effectively through myriad associated post trade lifecycle events and workflows, up to and including mandatory trade reporting to multiple global regulators. Market data - while evidently also mission critical - represents by far the smaller piece of the action.

Market data vs reference data

The clues are in the name. Market data is primarily the time and price at which a transaction was executed. Almost everything else you need to know about a trade - instrument issuer, trade counterparties, the specific identity of the product traded, trading venue, currencies, associated corporate actions and so on are essential reference data points that must be captured accurately to ensure that all parties to the transaction are on exactly the same page with respect to the transaction itself, and all subsequent actions that need to attach to it.

It’s also important to note that for certain types of financial markets products including futures and options that are based on forward pricing, reference data is not always a post event requirement.

The importance of accurate reference data

A rough breakdown of the reference data fields for a single futures contract transaction indicates at least 160 data points that must be populated in every transaction message. Multiply this by the number of futures and options contracts traded - over 30 billion annually in the last few years - across 100s of exchanges and platforms - and it’s become easier to see the size of the accurate reference data challenge.

Reference data makes up more than 70% of the trading data pie

It stands to reason, therefore, that any error or problem with this data, whether at source, in its submission to an end user application, or because of any other glitch in the matrix somewhere along the line in terms of missing or corrupted data is going to cause problems for front, middle and back offices and associated risk and compliance functions involved in end-to-end transaction processing.

No standardised codes for specific traded instruments

There is also another huge challenge with reference data that adds significantly more complexity to trade reporting. This arises from the fact that there are no prescribed and standardised codes to describe and identify specific traded instruments - in reality, they can be (ahem) referenced in different ways by different market intermediaries and data aggregation platforms. This means that they have to be converted or ‘normalised’ from one format to another to meet the specific description ‘language’ of different internal and external reporting destinations. And it's a constantly moving target.

Regulators come down hard on entities that report the wrong information, not least because reporting ‘valid but wrong’ identifiers continues to represent a significant percentage of regulatory reporting fails. With the EMIR Refit and other major regulatory reporting changes slated for 2024, regulators have put reporting-eligible counterparties on notice that they will have a low tolerance for regulatory reporting mistakes; expecting swift (and painful) remediation and re-reporting and threatening hefty fines.

For all of these reasons, having the right data in the right format is a growing imperative - and with over 25 years of experience in the reference data business, we can help you achieve this.

In our next blog we’ll discuss how institutions and financial firms can ensure that they get it right first time - and all the time.