Case Study

High quality reference data enhances enterprise data management efficiency for global alternative investment manager

About the company

Global alternative investment fund manager combining directional and relative value trading strategies (for uncorrelated returns) created by specialist investment, economics and quant teams.

Challenge

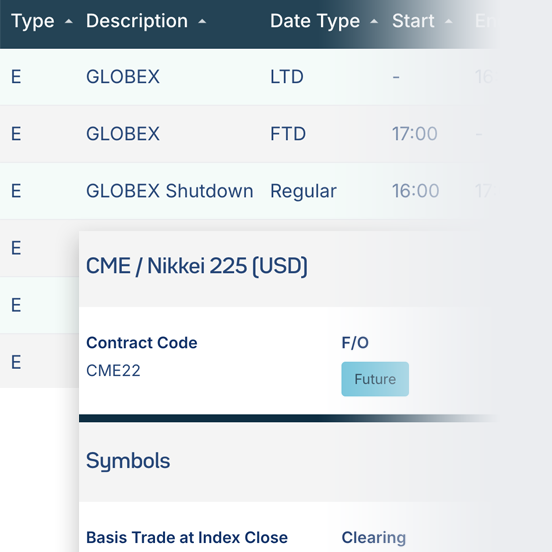

This firm, in the early stages of onboarding an enterprise data management system, sought to outsource provision of high quality derivatives data to support data analytics and quant trading teams.

Lack of data standardisation or quality assurance in way data delivered to EDM

Costly and ineffective multi-venue data sourcing strategy

Solution

The choice of FOW for derivatives reference data by this client was driven by our superior data quality standardisation and normalisation capabilities, and integrity of data validation and testing.

Extensive testing and rigorous UAT in onboarding phase

Quality data informing deterministic trading strategies

Cost-effective data solution supporting trade execution and reporting

Benefits

Seamless delivery of the right, high quality data directly to this client’s Enterprise Data Management system, with ability to flex and adjust data requirements as needed.

Client gets only the data it needs

Enriched data supporting specialist investment solutions

Enterprise data management (and cost) efficiency

FOW solutions

This client’s requirements were met with the following FOW solutions.

Download full case study

DownloadRequest a Demo

Find out how you can benefit from a seamless access to FOW’s extensive data, market analytics and industry insights.

Submit